Crypto analyst Javon Marks has revealed how Ethereum could recover and possibly break above its current all-time high (ATH) of $4,900. This came as he highlighted a bullish pattern that the altcoin was still maintaining despite the current crypto market downtrend.

Ethereum Eyes Rally To ATH Amid Hidden Bull Divergence Pattern

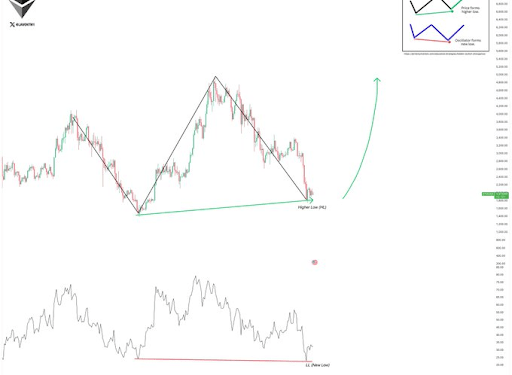

In an X post, Javon Mark noted that Ethereum is maintaining a larger Hidden Bull Divergence Pattern. Based on this, he declared that, with a full response, ETH could rally over 140% and even break its current all-time high of $4,900. His accompanying chart showed that the altcoin could rally to $5,000 by mid-year.

His prediction comes as Ethereum continues to struggle below the psychological $2,000 level. Despite this, Marks assured that there is still a strong possibility of a larger bull reversal in the works, as ETH has recently shown a positive response to the Regular Bullish Divergence pattern. The analyst has also predicted that the altcoin could still reach $8,500 as part of the broader macro picture.

Amid this bullish prediction for Ethereum, it is worth noting that Wall Street giant Standard Chartered has lowered its year-end target for ETH from $7,000 to $4,000, indicating that there is also the possibility that the altcoin won’t reach a new ATH this year. The bank also predicted that ETH could still drop to as low as $1,300 before it recovers.

Standard Chartered cited the decline in institutional demand as the major reason for lowering its Ethereum price target. Like the Bitcoin ETFs, the ETH ETFs have continued to record significant net outflows. SoSo Value data shows that these funds are currently on course to record their fourth consecutive month of net outflows.

How ETH Could Still Drop To As Low As $1,136

In an X post, crypto analyst Trader Tardigrade warned that a Bearish Pennant was forming, which could send Ethereum to as low as $1,136. The analyst noted that ETH is consolidating inside converging trendlines after the initial drop and that the pattern suggests continuation downward.

Trader Tardigrade further warned that a drop below the current range could trigger a sharp move down, sending ETH to the breakdown target of $1,136. However, the analyst appears to remain bullish on the altcoin in the long term. He had earlier stated that ETH was repeating a similar pattern from previous cycles in which a breakdown follows a consolidation before a recovery. This time, he predicts that Ethereum could rally to as high as $7,000 once it begins to recover.

At the time of writing, the Ethereum price is trading at around $1,968, up in the last 24 hours, according to data from CoinMarketCap.